Can A Jackpot Grow So Enormous That The Lottery Becomes A ‘+EV’ Play?

Combining straightforward calculations with uncertain approximations yields a mix of answers about "value" in lottery play.

7 min

The return-to-player, or RTP, on casino blackjack is typically over 99.5% if playing optimally. For slots, it’s usually between 92% and 96%. For a double-zero roulette wheel, it’s a shade under 95%.

For major lottery draws, the RTP can vary wildly but is generally calculated at somewhere between 50% and 70%.

There’s a reason people refer to the lottery as the worst play in gambling. Make no mistake, there’s still plenty of upside to buying tickets, whether from perspectives of entertainment value, opportunity to win life-changing money, or lottery profits supporting worthwhile causes. But purely mathematically and rationally, the expected value of playing the lottery is very much negative.

Under typical circumstances, that is.

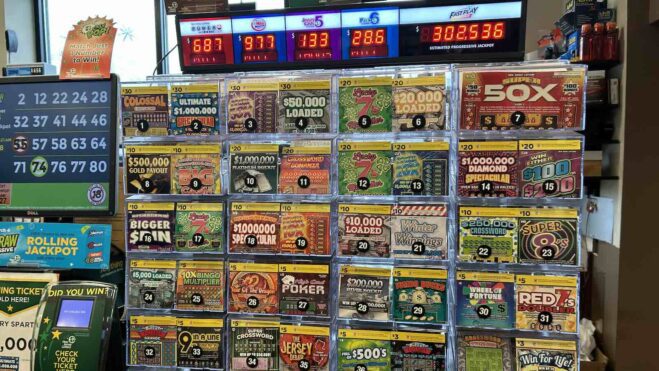

But what about under atypical circumstances? What about when the jackpots climb into the hundreds of millions — as is the case for Powerball and Mega Millions as of this writing — or the billions? Can buying a lottery ticket ever be an expenditure that has a positive expected value (“+EV”), meaning the average final value after accounting for all possible outcomes is greater than the cost?

‘Lottery math is really quite easy’

The short answer is yes, it can, in theory. But has it ever been +EV? Will it ever be +EV in the future? The answers to those questions are not entirely unanimous among statistics experts.

That’s because calculations of Powerball and Mega Millions jackpot value involve at least one major variable: How many other people are buying tickets, and in turn what is the probability that if you win the jackpot, you’ll be splitting it with one or more other players?

The odds of winning the Powerball grand prize with any singular ticket, by pairing each of five white balls numbered 1 through 69 and a red Powerball between 1 and 26, are 1 in 292,201,338. For Mega Millions, which has the same rules but features 70 white balls and 25 gold Mega Balls, the corresponding odds are 1 in 302,575,350.

“Lottery math is really quite easy,” said Mike Shackleford, a former actuary known in the gambling community as “The Wizard of Odds” (who is the proprietor of WizardOfOdds.com). “It’s very straightforward, using the binomial theorem to calculate the probability of any given win.”

“Quite easy” and “straightforward” mean something different to “The Wizard of Odds” than to the average person, but still, we see where he’s coming from — at least in terms of the basic starting point. Even after one accounts for the fact that the advertised jackpot is not the dollar amount a sole winner would actually keep — because the lump-sum amount is much lower and there are taxes to be paid — you don’t need to be a wizard of anything to grasp the basic concept at play here.

But things do get more complex from there.

Ken Alexander, a mathematics professor at USC with a Ph.D. from MIT, concurs with Shackleford that calculating the chances of a win with any single ticket is straightforward, but said approximation is required when seeking to define the ticket’s expected value.

“You have to look at, what’s the average fraction that you’re going to get of the jackpot,” said Alexander, who emphasized that he’s not an expert on the lottery, just on probability. “There’s a chance you’re the only winner, there’s a chance you’ll get half the amount if there are two winners, and so on. There’s an average value that comes out of all those possibilities that you have to take into account.

“And once you talk about things like what’s the average number of people you’re going to share the prize with, then any calculation you do is approximate, because other people don’t just all pick numbers at random. There are some numbers, like birthdays, that people pick more often. You can pretend that everybody just picks their numbers at random and then you can calculate for that situation readily. But it still involves some approximation because you don’t have the actual data about how many people bought tickets.”

Has it EV-er happened?

Logic dictates that as a jackpot rolls over and grows, more people will buy tickets. And the more people that buy tickets, the higher the chance of multiple winners dividing the top prize.

In 2010, mathematician Skip Garibaldi co-authored with Aaron Abrams a paper titled “Finding Good Bets in the Lottery, and Why You Shouldn’t Take Them,” and reached the conclusion that “no drawing of either [Powerball or Mega Millions] has ever been a good bet.”

But that was several years before jackpots began crossing into the billions (for the annuity option). Garibaldi suspects, without having fully re-crunched all the numbers, that we have seen +EV lottery plays in recent years. He specifically singled out the all-time record Powerball jackpot hit on Nov. 7, 2022 of $2.04 billion, which equated to just under a billion dollars for the lump-sum option.

“The weird thing about that jackpot is that it looks like they only sold around 279 million tickets,” Garibaldi said. “It’s a much smaller number of tickets than you would expect with a jackpot that big. So I think that particular drawing, and maybe a couple before it, would have had a positive expected value.”

Garibaldi also noted in his 2010 paper that Lotto Texas, with its more modest ticket sales compared to national drawings, could at the time “offer positive rates of return, once the jackpot exceeds a certain easily computed threshold.” But he spelled out that “drawings with ‘large’ ticket sales … will always have negative rates of returns.”

In short: He isn’t so sure his beliefs expressed 14 years ago hold up, at least under the rare circumstances when jackpots grow enormous and public interest fails to match that enormity.

Starting points and midpoints

In his paper, Garibaldi defines a point he calls “the jackpot cutoff,” a dollar figure the jackpot must rise to before you can even begin to consider the possibility of a ticket being a +EV expenditure.

In a hypothetical world in which you could be certain that if you won you would be the only winner and wouldn’t have to split the pot, all you would need to know is where that cutoff lies.

Shackleford has gone through a similar thought process and made similar calculations and said that “somewhere over the half-a-billion dollar mark, it starts to get into that territory.” But, unlike Garibaldi, he doesn’t believe these lotteries have ever reached a +EV state.

“Because of the combination of taxes and jackpot sharing, it never gets positive,” Shackleford said.

He actually theorized that there’s a more moderate jackpot point at which the expected value, though not positive, is at its least negative: “The best point to play is at a jackpot of about $300 million,” Shackleford said, “because once it starts getting bigger than that, the demand is exponential for tickets and it starts becoming much more likely that you’re going to have to split the prize.”

USC professor Alexander — again, a probability guy, not necessarily a lottery guy — said of the +EV question, “I don’t know if it ever actually happens. If it does, it would be rare.

“But it is, in principle, possible.”

Artificial answers

Enough with all these human number crunchers. What does the real expert — ChatGPT — say?

We asked, “How high would the Powerball jackpot need to be for it to be +EV to buy a ticket?”

ChatGPT went full AI politician, hemming and hawing and not committing to an answer.

“To calculate whether it’s mathematically advantageous to buy a Powerball ticket, you’d need to consider the expected value (EV) of the ticket. The expected value is calculated by multiplying the probability of winning by the amount won, and then subtracting the cost of the ticket,” ChatGPT began.

Yeah, yeah, we know. Cut to the chase.

“Keep in mind that this is a simplified calculation and doesn’t take into account taxes, the possibility of splitting the jackpot, and other prizes you might win. It’s also crucial to remember that gambling always carries risks, and the expected value is just a statistical measure that doesn’t guarantee any specific outcome.

“Therefore, without specific jackpot information, it’s impossible to provide an exact figure for when buying a Powerball ticket becomes +EV. However, it’s typically when the jackpot reaches extraordinarily high levels, often in the hundreds of millions or even billions of dollars.”

Thanks for nothing, buddy.

Lottery vs. casino

There are some numbers that can be easily calculated, and others that need to be approximated, and thus no unanimously agreed upon conclusion.

But there’s also more to this conversation than just the numbers.

Garibaldi, who said he usually buys a few tickets when the jackpots get huge— “I spend less than $150 a year on lottery tickets,” he specified — gladly makes the case for playing the lottery even though the math tells him it’s not a favorable investment.

“There are a few things that are arguing in the lottery’s favor, even if casino gambling offers a better return on your dollar,” he said. “First, when you go to a casino and you want to play one of their games, you’re going to make that bet a lot of times. So, if you’re making a disadvantageous bet many times, because that’s what you do in casino play, that adds up. And then maybe you’re in the same zone as the lottery.

“The other thing I would say is in the lottery’s favor is it has a huge variance. You could buy one lottery ticket for the cost of a candy bar, and even with the smallest possible jackpot (Mega Millions and Powerball both reset to $20 million after they’re won), that would be enough for me. And I’m never going win that through that table games.

“Also, I think that there’s less risk of pathological gambling,” Garibaldi noted. “If you look at what pathological gamblers do, it’s not buy Mega Millions tickets.”

In the end, hardly anyone buying Mega Millions or Powerball tickets is pausing to ponder whether their $2 purchase has an expected value of $1.56 or $1.78 or maybe, if the jackpot is gigantic enough and the chances of a split pot are modest enough, $2.05 or $2.10.

For most customers, expected value never crosses their mind. All they see is potential value.

Let the statisticians crunch their numbers, but the main reason lottery sales growing continue to grow after year is that there’s only one number most people care about: the big one up top.