A lottery ticket can sometimes feel like an investment. After all, there’s always the slightest chance that you might convert your $2 ticket into a $200 million payoff.

But when you don’t win, which is almost always the case if you’re a Powerball player, where does the money from your ticket actually go? Well, as it turns out, by playing the lottery, you’re investing in a lot of things. And thanks to existing and future lottery laws, those things may well benefit you.

Where does money from lottery sales go?

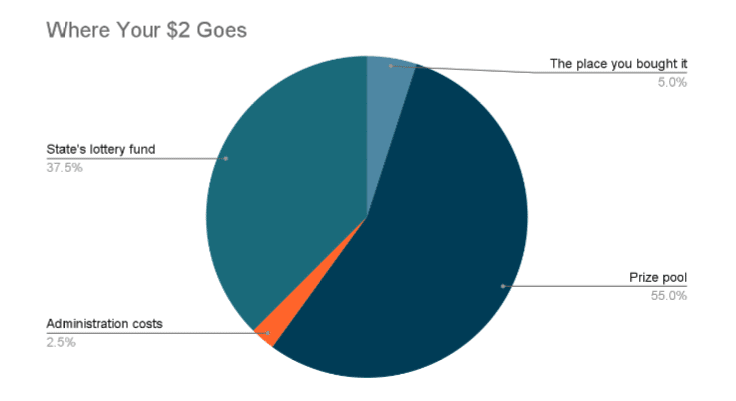

Say, for instance, you bought a $2 scratch-off at 7-Eleven. You can expect 5%, or $0.10, to go to the 7-Eleven that made the sale. You can also expect the majority – probably about $1.10 – to go into the actual jackpot. There needs to be a prize pool for people to actually win a prize, right?

Then there’s about 80 cents left, and that’s where things get more complicated. While a few cents of that will always assist with the administration of the lottery – purchasing new machines, for instance – the bulk of it will go towards your state’s lottery fund.

While lottery administration and regulations vary state by state, the following visualization represents a typical distribution:

What does your state do with its lottery fund?

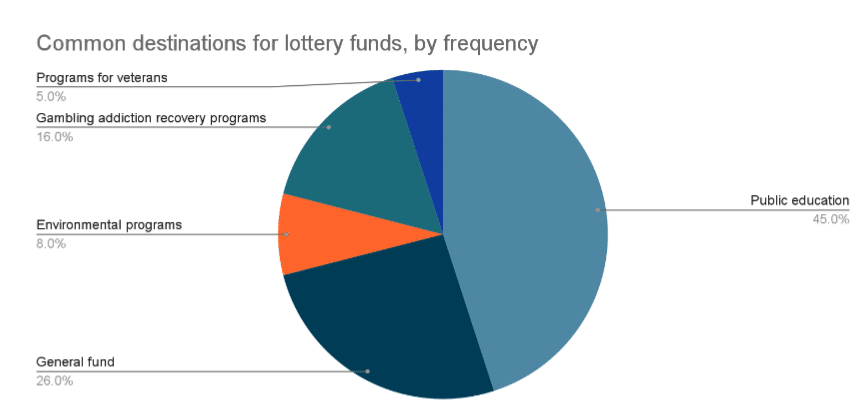

Of course, not all state lottery funds are created equal. Many states funnel their lottery revenue into education, but a few states have very specific destinations for their lotto funds.

Pennsylvania, for instance, spends some of its lottery revenue on rent and property tax assistance for the elderly. Meanwhile, Massachusetts saves some of its funding for the arts; Maryland and Washington, on the other hand, use lottery revenue on sports stadium operations. Several states just dump their lottery revenue into a general fund, which bankrolls any number of initiatives from highway construction to environmental protection.

In fact, Alabama and Georgia are both in the process of shaping their lottery funds for posterity. As part of the Alabama House’s move to legalize gambling in the state, there may be a new law that earmarks lottery revenue for education purposes.

Meanwhile, Georgia Republicans are attempting to invest the state’s lottery surplus in Pre-K teacher salaries, while the state’s Democrats are hoping to invest the money in higher education. Similarly, Oklahoma already passed a law in 2022 that allowed for more competitive salaries among teachers.

If you’re curious as to exactly where the money raised by your state’s lottery fund goes, you can refer to this rundown by NPR. In this diagram below, we’ve identified the most common destinations for lottery funds around the country:

Is your state using its lottery fund effectively?

Theoretically, lottery funds allow for states to levy fewer taxes and thus maintain political support from elected officials. However, some lottery funds lack sufficient oversight, leading some states to misappropriate them.

For instance, in 2020, the California Lottery was found by an auditor to owe $36 million to public schools. This was mostly due to an outdated prize payout scheme and a lack of responsibility on the part of the State’s Controller’s Office, but it certainly indicated an overall need for better oversight of lotto funds.

In fact, a similar problem occurred rather recently in South Carolina. According to a State Inspector General in November 2023, the state’s Commission on Higher Education had kept $152 million in lottery funds that was meant to fund scholarships for high-performing students. It was too late to spend it on anything else, but the finding still exposed a general mishandling of the state’s lottery budget.

Thankfully, those are both relatively isolated incidents. In most cases, as a lotto player, you can expect your money to go towards a good cause. Whether you’re supporting your local 7-Eleven, the printers for your scratch-off tickets, your state’s public education, or your own $200 million payout (fingers crossed), you’re not merely throwing away $2 on a whim – no matter what your financial advisor says.