Detailed Report Shows Productivity Of New England Lottery Sales

The region is benefiting from increased sales as it outpaces the rest of the U.S.

2 min

Lottery sales across New England remain a crucial component of state revenue, with trends showcasing a mix of growth, challenges, and regional idiosyncrasies. A detailed report released Tuesday, written by Riley Sullivan of the Federal Reserve Bank of Boston, explores how the states in the region measure up against each other.

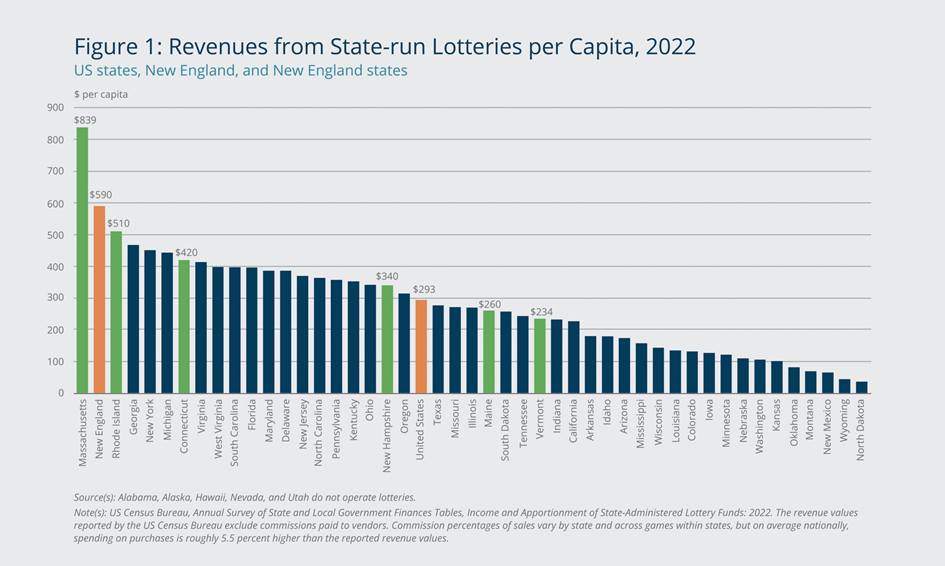

Sullivan’s report, “New England’s Lotteries: Trends in State Revenues and Player Spending,” shows that New England exhibits remarkably high per capita lottery spending, with Massachusetts topping the national average at $839 per person annually. The national average is just $293.

In 2022, Massachusetts residents spent 0.99% of their personal income on lottery games — the highest rate in the country and more than twice the national average of 0.45%. Across all New England states, the rate was 0.75%. (These per-capita figures exclude under-18 individuals who cannot legally buy tickets.)

On payouts and challenges

Prize payouts, when measured as a share of personal income, were notably smaller than lottery spending, both regionally and nationally. In New England, payouts accounted for 0.52% of personal income, compared to 0.3% nationally. Massachusetts again led the country, with payouts representing 0.73% of personal income.

In 2022, New England states awarded $6.2 billion in prizes from $8.9 billion in lottery sales. Rhode Island stood out with the nation’s highest per capita losses from lottery purchases, at $330, ranking third in lottery spending as a share of personal income (0.8%) and 22nd in payouts (0.28%).

These figures reveal a significant gap between spending and winnings, where a small number of players receive large payouts while most experience losses.

While lottery sales have steadily increased, their growth has lagged behind other revenue streams. The introduction of legalized sports betting and mobile lottery ticket purchasing apps like Jackpocket and Lotto.com presents both opportunities and risks.

Sports betting, for instance, has generated significant tax revenue in Massachusetts, but it could divert spending away from lotteries. On the other hand, apps like Jackpocket have increased accessibility to lotteries, potentially boosting sales.

Regional differences in growth rates further complicate the landscape. For instance, while New Hampshire has seen a surge in lottery sales, Rhode Island’s growth has been modest, with notable declines between 2019 and 2021.

Socioeconomic and ethical implications

Participation in lottery games varies based on factors such as age, gender, and income. While higher income may enable more discretionary spending, Massachusetts data shows that lower-income communities tend to spend more on lottery tickets, even in relatively affluent states. There are complex socioeconomic factors that influence lottery participation and spending habits.

Lottery spending relative to personal income is significantly higher in New England compared to the national average, according to the report. The nearly 1% of their personal income that Massachusetts residents spend on lottery games is more than double the national average.

The concentration of lottery losses among frequent players and the uneven distribution of winnings highlight concerns some observers have. While the lotteries generate vital funding for public services, these patterns point to significant sustainability challenges.

Lottery courier services are expected to enhance lottery revenue, particularly in the early stages. By making lottery games more accessible, these apps can expand the customer base and drive higher sales. However, policymakers must carefully weigh the advantages of this increased accessibility against the potential risks associated with greater exposure to gambling products. Some feel New England’s reliance on lottery revenue for critical services like education and municipal aid necessitates a proactive approach to sustaining these funds.

Sullivan suggests that innovative strategies, such as integrating lotteries into broader gaming portfolios or enhancing transparency and fairness, could help mitigate risks. Moreover, diversifying funding sources for public services may reduce the over-reliance on lotteries, ensuring a more stable and equitable revenue base.